How To Borrow USDL (Step-By-Step Guide)

So you’re ready to collateralize your PLS holdings and mint USDL.

Use our Step-By-Step Guide to make sure you are borrowing USDL correctly.

How To Borrow USDL

Step 1: Obtain PLS

In order to borrow USDL, you need PLS to lock in a vault as collateral.

If you need help, use our guide on How To Buy PLS.

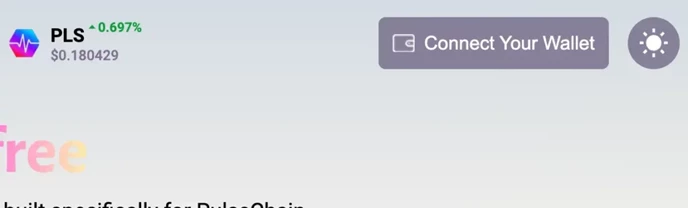

Step 2: Visit The Liquid Loans dApp

The link for the Mainnet dApp is here: https://go.liquidloans.io/#/

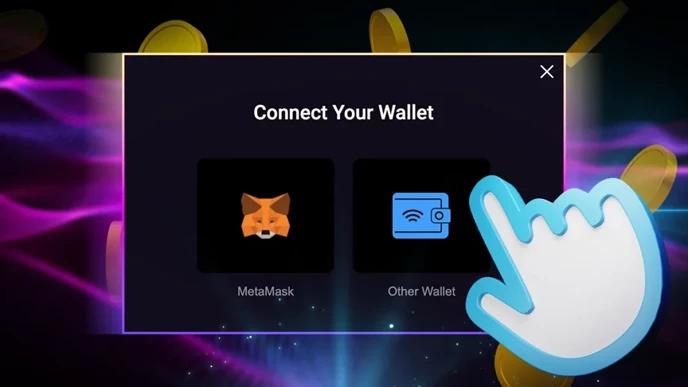

Step 3: Connect Wallet

Once you’ve signed into your wallet, click “Connect Wallet” in the top right corner of the dApp.

Choose Metamask Wallet or Other.

Step 4: Borrow USDL

Choose “Borrow USDL” from the left hand sidebar.

Choose the amount of PLS you want to collateralize and the amount of USDL you want to borrow.

We chose a 250% collateral ratio for safety.

Click Confirm.

Once the transaction is validated you have officially borrowed USDL!

Next Steps

There are many things you can do with your newly minted USDL:

- Deposit it into the Stability Pool to earn rewards in PLS and LOAN Token

- Provide LP on PulseX for the USDL:PLS pair. Use your LP tokens to earn LOAN token rewards within the Liquid Loans dApp.

- Enjoy your liquidity to pay your bills, buy a house, or invest in another asset.

Considerations Before Borrowing

Opting to borrow USDL entails the potential drawback of jeopardizing your PLS holdings through a liquidation.

Even though your USDL remains intact, a liquidation would incur an immediate loss of up to 10%.

While liquidations have specific scenarios where they might be desirable (i.ie. stop loss during big market correction), most individuals will opt to avoid it.

As a prudent measure, it's advisable to establish a robust collateral ratio, such as 250%.

If you opt for a collateral ratio lower than that, it's essential to stay vigilant regarding downward price volatility of PLS.

Should you observe your collateral level nearing the 110% mark, it is smart to promptly repay your loan to avert the risk of liquidation.

In summary, borrowers should carefully manage their collateral ratios to mitigate the potential impact of liquidation, safeguarding their holdings and financial well-being.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Connor

Connor is a US-based digital marketer and writer. He has a diverse military and academic background, but developed a passion over the years for blockchain and DeFi because of their potential to provide censorship resistance and financial freedom. Connor is dedicated to educating and inspiring others in the space, and is an active member and investor in the Ethereum, Hex, and PulseChain communities.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant