PulseX Complete Guide: The Best Decentralized Exchange on PulseChain

Other than PulseChain itself, PulseX was the most anticipated DeFi protocol of 2023.

It launched on May 12th, 2023 and did hundreds of thousands of transactions in the first few hours.

This article will deep dive into everything you need to know about the decentralized exchange.

What is PulseX (PLSX Explained)?

PulseX is a decentralized exchange on PulseChain that facilitates the exchange of tokens ("PRC20s"). The platform operates similarly to Uniswap v2 on Ethereum, uses the staking model of Pancakeswap, and allows users to trade currencies from other chains via bridges.

PulseX is also the largest yield farming platform globally, as liquidity providers earn fees every time a user swaps one coin for another. Users can pair their ERC20 tokens with free PRC20 tokens to provide liquidity and earn fees, which helps to support the value of the PRC20 tokens.

To further incentivize liquidity providers, PulseX has introduced a second token, the incentive token (INC), that rewards LP token holders who deposit them in a yield farm. This new token, which has yet to be named, has decreasing inflation over time, and the PulseX DAO determines the trading pairs that receive incentives and at what rates. Only addresses with PLSX balances can vote in the DAO.

PulseX's primary objective is to provide PulseChain users with the best possible trading experience and yield farming platform while also encouraging ERC20 holders to bridge in and support the value of their free PRC20 tokens.

Why are Decentralized Exchanges Important?

Decentralized exchanges (DEXs) are important for several reasons:

- Decentralization: Unlike centralized exchanges, DEXs operate on a decentralized network, which means that they are not controlled by a single entity or organization. This makes them less vulnerable to hacking, government regulations, and other types of interference.

- Privacy: DEXs do not require users to provide their personal information, such as their name or address, to use the platform. This provides a greater degree of privacy and anonymity, which is important for many users.

- Security: DEXs use smart contracts to execute trades, which eliminates the need for a middleman. This reduces the risk of fraud, as the trades are automated and transparent.

- Accessibility: DEXs are open to anyone with an internet connection, regardless of their location or financial status. This makes them more accessible to people who may not have access to traditional banking services or who live in countries with strict financial regulations.

PulseX Price Prediction 2025

Cryptocurrencies have emerged as the best performing asset class in the past decade. The reason behind this is that they eliminate counterparty risks and middlemen, provide privacy, and boast better uptime than traditional banking and credit card networks. Cryptocurrencies also enable users to log in to platforms using cryptographic username and password pairs, independent of the platform.

If you hold PLS or PRC20s, you can provide them as liquidity to PulseX and earn yields on them, which can be less risky than trading and offers an opportunity for yield. Cryptocurrencies yield higher returns compared to other asset classes.

PulseX provides the most transparent trading experience as it enables users to see on-chain which addresses trade which assets, and how much money they have left to buy more.

In terms of efficiency, transacting on PulseChain costs less than $0.01, and confirmations occur in about 10 seconds, while Bitcoin transactions can take from minutes to hours and cost multiple USD in fees. PulseX utilizes this network to enable fast and affordable swaps between PLS and PRC20s.

PulseX offers lower fees than most other competing exchanges, making it a more cost-effective option for users. Most tokens inflate at high rates, whereas PLSX maintains a fixed supply, making it rarer over time. Additionally, 21% of all fees on PulseX can be used to buy up PLSX and burn the freshly purchased tokens, thereby increasing their rarity.

What was the PulseX Sacrifice?

The sacrifice phase for PulseX started in January of 2022 and ended in February of 2022.

Sacrificers sent money to a sacrifice address to make a political statement for freedom of movement.

If you sacrificed, you can check your points here.

How Do I Buy PulseX?

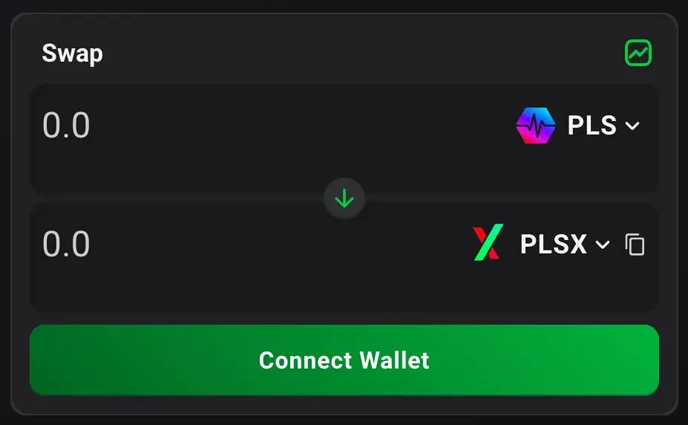

PLSX token is now available to buy on PulseX.

- Visit: https://app.pulsex.com/

- Click "Connect Wallet"

- Choose a pair and click "Swap" (NOTE: Pay attention and price impact and slippage, especially in the early days of PulseChain.)

PulseX Mainnet

PulseChain Mainnet went live on May 12th, 2023.

The https://t.co/vZIuPqXDpo main net is now live.

— Richard Heart (@RichardHeartWin) May 13, 2023

The PLSX contract address on the PulseChain main net is: 0x95B303987A60C71504D99Aa1b13B4DA07b0790ab and has 18 decimals.

How To Stake PulseX

PulseX staking works via a mechanism called single-sided staking which earns them rewards in a variety of different tokens.

Holders can stake a capped amount of PLSX tokens in sponsored pools.

These sponsored pools are essentially projects which are giving away “freemium” with hopes of onboarding more users into their projects.

The sponsored pools are chosen via a DAO vote.

PulseX DAO

The PulseX DAO has responsibility for voting on two aspects of the protocol:

- Which pools to sponsor for PLSX staking

- Which Liquidity Pools to reward with the Incentive Token (INC)

The PulseX voting works simply: 1 PLSX, 1 Vote in the DAO.

Even users who have their PLSX in liquidity pools or in the staking contracts retain the ability to vote.

PulseX DAO Proposal for USDL

Liquid Loans is proposing that PLSX holders vote to provide incentive token for pools such as USDL/PLS, USDL/eUSDC, and USDL/PLSX.

The reason for this is:

- USDL is a truly decentralized, fully collateralized, admin key free stablecoin. Promoting its use moves our blockchain away from centralized, censorable and fractionally reserved stablecoins such as USDC, DAI, and Tether.

- One USDL, by definition, is $1 of PLS that cannot hit the market as sell pressure. Promoting USDL promotes PulseChain.

PulseX Incentive Token

The PulseX Incentive Token (INC) is a token which is paid out to liquidity providers of certain pools that are chosen by the DAO.

As the name suggests, the Incentive Token rewards liquidity providers to build up thick liquidity on the pairs which the community decides is best for the collective.

PulseX Tokenomics

Three features make PulseX tokenomics superior to any other DEX token:

- Buy and Burn - 21% of the fees of the exchange are used to buy PLSX and send it to an address that will never sell. This results in constant buy pressure and eliminates sell pressure.

- No inflation - The supply of PLSX was determined by the amount sacrificed, thus the supply is locked and will never increase.

- Staking - holders of PLSX need a reason to do so. Staking gives holders the ability to earn yield while holding.

PulseX Fee Structure

PulseX has implemented a highly competitive fee structure for its users.

With a 0.29% fee on each swap, it beats out popular exchanges such as Sushiswap, Trader Joe, Quickswap, and Uniswap. Of the 0.29% fees on each swap:

- 76% is distributed to the Liquidity Providers

- 21% could be used to buy and burn PLSX

- 0.01% goes to an address you must have no expectations of

Overall, PulseX's fee structure is designed to be highly beneficial for its users, liquidity providers, and token holders.

PulseX Buy and Burn

The PulseX buy and Burn is a highly price positive function for PLSX because it:

- Creates constant buy pressure on PLSX tokens

- Removes that same amount from ever hitting the market as sell pressure

The buy and burn does a “fee scrape”. In this instance, it takes 21% of the trading fees on the platform and uses it to buy PLSX and send it to the null address.

For example, if somebody swaps 1000 USDL to PLS, 29 USDL is taken as a fee.

21% of the 29 USDL is 6.09 USDL.

Now, 6.09 USDL is sent to the Buy and Burn contract which will swap 6.09 USDL for the corresponding amount of PLSX.

This PLSX is then sent to the null address (0x000000…00000) where it will stay forever.

The Bottom Line

- PulseX will most likely have the most liquidity of any DEX on PulseChain.

- The PulseChain community would benefit from thick liquidity between the major coins (PLS, PLSX, and LOAN) and a truly decentralized native stablecoin such as USDL.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Connor

Connor is a US-based digital marketer and writer. He has a diverse military and academic background, but developed a passion over the years for blockchain and DeFi because of their potential to provide censorship resistance and financial freedom. Connor is dedicated to educating and inspiring others in the space, and is an active member and investor in the Ethereum, Hex, and PulseChain communities.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant