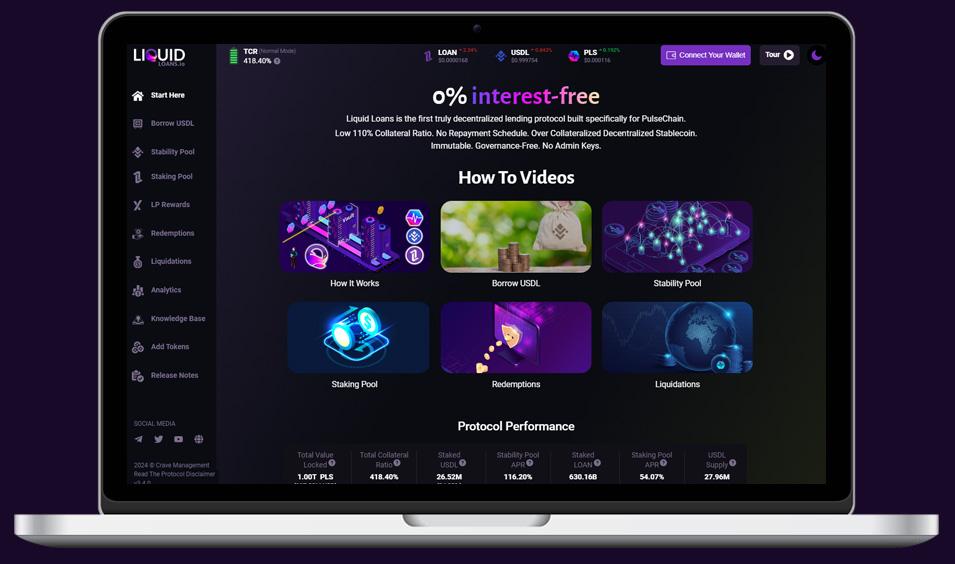

Liquid Loans is the first truly decentralized lending protocol built specifically for PulseChain.

Fully Backed Stablecoin. Low 110% Collateral Ratio. No Repayment Schedule. Immutable. Governance-Free. No Admin Keys.

Main

Use CasesLiquid Loans core purpose is to support the creation, growth and adoption of a more secure, trustless, and decentralized financial infrastructure, that is community-owned, and brings greater stability and transparency to the PulseChain ecosystem.

0% Interest Rate

1 USDL = 1 USD

110% Collateral Ratio

The Protocol Has Two

Native Tokens

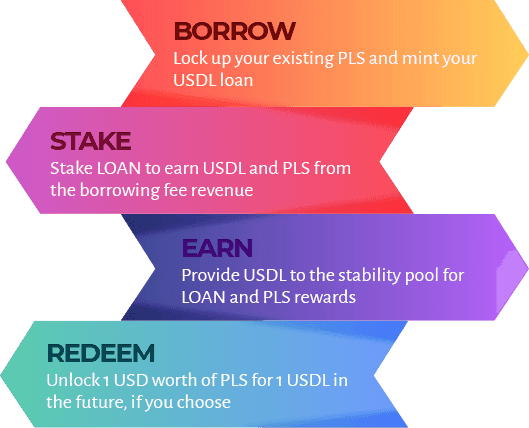

The protocol was developed to allow owners of PLS a method of extracting value from their holdings, without the need to ever sell. By locking up PLS and minting USDL, a PLS holder can take a 0% interest-free loan against their holdings, on a timeless repayment schedule.

To do this, you deposit your PLS into a smart contract called a Vault, which in turn mints the USDL stablecoin. The minimum collateral ratio you can lock up is 110%, however a ratio of 150% or more is strongly recommended. Use your USDL for a variety of personal uses, or reinvest into the system to provide stability and take advantage of another journey on the ecosystem.

USDL – as a holder of USDL, you can earn income by providing stability to the Liquid Loans ecosystem. Invest and achieve a return on your USDL using gains earned through liquidation events plus incentives provided in the form of LOAN tokens.

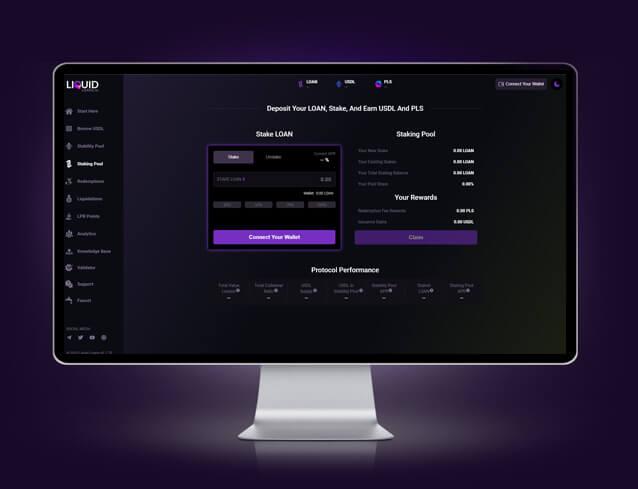

LOAN – holders of LOAN tokens can then stake their tokens in the ecosystem to earn USDL and PLS. Earnings are generated from borrowing and redemption fees, and are provided in the same proportion as the amount you have staked in the staking pool.

OPEN A VAULT

STABILITY POOL

LOAN STAKING

Got Questions? Join Approx 10,000 Members In Our Telegram – Ask Them Here

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant