Wrapped Tokens: Why They're Risky, But Why We Need Them

Wrapped tokens, also known as bridge tokens, represent digital assets that are pegged to the value of other cryptocurrencies. They are called “wrapped” because they are put inside a specific digital vault that enables the usage of these tokens within other blockchain systems.

Okay, but what’s the point? What are the reasons for using such a strange technology in the first place?

The answer lies in one of the most critical issues inherent to blockchain systems. It’s the lack of interoperability, i.e. impossibility to make direct cross chain transactions.

Take Bitcoin and Ethereum, for example. One cannot simply send ethers from ETH to a BTC crypto wallet. These two systems stand on totally different algorithms which makes it impossible for them to freely exchange funds.

This is exactly where wrapped tokens come into the light. How do they work and what advantages do they provide? Let’s take a closer look.

Key Components Of Wrapped Tokens

First, it’s important to understand what wrapped tokens comprise. Their key elements include the following aspects:

- An underlying asset. This is an original asset that a wrapped token represents on a different blockchain. It may be a cryptocurrency, an NFT, or any other type of digital token.

- Blockchain. Different blockchain platforms feature different algorithms that affect the rules of token creation.

- Smart contract. These self-executing contracts make it possible to mint wrapped tokens. They define the rules for wrapped tokens’ creation and implement these rules in a fully automated manner.

- Token standard. This is the set of rules for a wrapped token to follow which depends on the blockchain platform that the token runs upon. Thus, an ERC20 token standard stands for Ethereum blockchain, TRC20 for TRON, and BEP20 for Binance Smart Chain.

- Crypto exchange. Centralized digital exchange platforms are the most popular option for purchasing and selling wrapped tokens.

How Do Wrapped Tokens Work?

To understand the specifics of how wrapped tokens work, let’s analyze Wrapped Bitcoin, one of the most popular assets of this class.

WBTC represents a tokenized version of Bitcoin on Ethereum with the value pegged to the price of Bitcoin. As an ERC20-compliant token, it can be used within the Ethereum network just like ethers and other tokens running on this standard.

For the whole procedure to become possible, there is a custodian that holds an equivalent amount of BTC in a wrapped form. This may be a DAO, a merchant, or a smart contract.

In the case of WBTC, this custodian must hold 1 BTC for every wrapped version of Bitcoin that is minted on the network. Here’s what the process looks like:

- A user sends some bitcoins to the custodian.

- The custodian mints an equivalent sum of WBTC on Ethereum and sends the new assets to the user.

- To change WBCT back to BTC, the user sends a burn request to the custodian who, in turn, releases BTC from the reserves.

Thus, the custodian performs the function of wrapping and unwrapping.

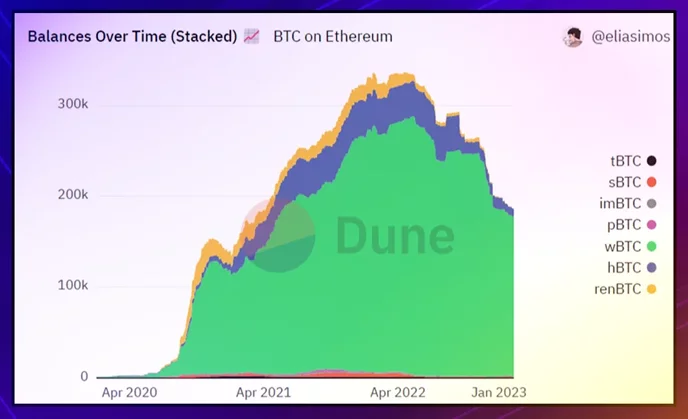

Since the launch of Wrapped Bitcoin in January 2019, many other wrapped versions of this token have emerged. Thus, now there exist Huobi’s HBTC, Ren platform’s renBTC, and other Ethereum-based solutions like tBTC and RenBTC. However, Wrapped Bitcoin WBTC still features the largest market cap.

The chart above from Dune shows that WBTC beats all of its competitors by market capitalization.

Stablecoins vs Wrapped Tokens

In a way, wrapped tokens have a lot in common with stablecoins. Indeed, USDT and USDC derive their value from a US dollar similar to the way wrapped tokens derive theirs from other cryptos.

Yet, there is still a major difference. Unlike WBTC, stablecoins do not feature a physical dollar for every minted asset.

Fiat-based stablecoins rely on cash and other real-world equivalents in their reserves. Crypto-backed stablecoins maintain stability by over-collateralization. Finally, algorithmic assets rely on complex algorithms that reduce or increase the circulating supply of underlying tokens according to the current demand.

This is the key characteristic that makes these two solutions stand apart from each other.

Why Do We Need Wrapped Tokens?

The most crucial reasons for using bridge tokens include the following:

1. The Lack Of Interoperability

The lack of interoperability across different blockchains has long been a stumbling block for the whole crypto industry.

Cunning minds have invented a number of different ways to solve this problem. Yet, bridges that rely on wrapped tokens have proved to be the most user-friendly and easy solution so far.

2. The Growth of DeFi

Second, the extensive growth of the DeFi industry as a whole requires a solution to transfer native tokens across different blockchains in a quick and easy manner. This is exactly where wrapped tokens are to help.

3. Extended Use Cases

Finally, this technology is applicable not only to cryptocurrencies. It may extend its usage to NFTs, other crypto assets, and even real-world commodities.

Advantages Of Wrapped Tokens

With everything mentioned above, one may highlight the following advantages of wrapped tokens.

- Interoperability. Wrapped tokens close the gaps across different blockchains and enable fast and smooth transfer of value.

- Increased liquidity and capital efficiency. Both centralized and decentralized exchanges benefit from wrapped tokens by increasing the liquidity of assets that would otherwise remain idle on users’ accounts.

- Accessibility. Thanks to wrapped tokens, native assets become more accessible and thus create new investment opportunities.

- Lower fees. While Bitcoin is a great crypto for storing value, it may not be the best option for daily transactions due to the high network fees and long confirmation times. A wrapped version of BTC on a different blockchain with lower fees and faster transaction times may be a good solution to this problem.

Disadvantages Of Wrapped Tokens

Indeed, wrapped tokens eliminate many problems inherent to Bitcoin and other cryptocurrencies. Yet, they have some drawbacks as well:

- Conversion fees. While a wrapped version of Bitcoin may feature smaller transaction fees, one still has to pay network fees to get an alternative token.

- Market contagion risks. Crypto contagion refers to a situation when a failure of one crypto asset results in the failure of many others. Thus, if a custodian managing the collateral vault fails, other apps using its wrapped tokens may face a liquidity crisis.

- Inequivalent value. When the market is particularly volatile, wrapped tokens may have a lower value than the assets they represent.

- The necessity to trust a custodian. This is, perhaps, the weakest link of the whole solution. Since wrapped tokens are backed by a custodian, there is always a counterparty risk.

How to Reduce Security Risk for Wrapped Tokens?

Wrapped tokens have a lot of advantages that contribute to the adoption of cryptocurrencies. Yet, the security aspect may easily bring down all these benefits to zero.

In order to use wrapped tokens, one has to fully trust the custodian. Such an approach defeats the whole purpose of using cryptocurrencies. The custodian may unlock the underlying asset and give it away to someone else at any time and thus make its wrapped version totally worthless.

Luckily, things don’t have to remain this way.

Decentralized bridges can become a good alternative to existing methods. The unbiased code based on immutable time-stamped smart contracts can stand in place of centralized custodians. Thus, it can eliminate the need for trust and provide all the participants of the process with a tool devoid of risks inherent to centralized entities.

Such solutions are still in their nascent stage of development. Besides, vulnerabilities in smart contracts can open up the gates to hackers’ exploits.

Yet, this is not the reason to despair. The technology evolves while getting broader adoption. Also, blockchain developers treat the security of their projects more seriously. Therefore, decentralized bridges for wrapped tokens will surely to replace their centralized alternatives to some extent.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant