What is Total Value Locked (TVL) in DeFi? How It Is Calculated and Manipulated

What is Total Value Locked (TVL)?

Total Value Locked (TVL) is a metric for measuring the total value of assets locked into decentralized finance (DeFi) protocols.

This indicator shows the total value of assets deposited within lending and borrowing protocols, yield farming platforms, decentralized exchanges, and any other solutions based on smart contracts. At this, it represents a very important aspect for investors to consider before investing in a given project.

In fact, it is a way to gauge the overall growth and adoption of the DeFi ecosystem, as well as the level of trust that users have in these protocols.

Yet, TVL may not be the most efficient tool for such purposes. Moreover, it may be deceptive and make someone confuse wishful thinking with real facts.

"TVL can be a useful metric, but similar to market cap, it doesn't tell the whole story and can be easily manipulated. It does give some level of insight into the participation and conviction of a protocol. You can add this to your list of data points, but don't over value it."

- WaLLrus

Same Measurement, Different Values for TVL

Independent TVL reflects the sum of all the locked funds in dollar equivalent. Since blockchain is public and fully transparent, one may think that it must be quite a simple task to evaluate this metric.

However, things are not as easy as they may seem at the first glance.

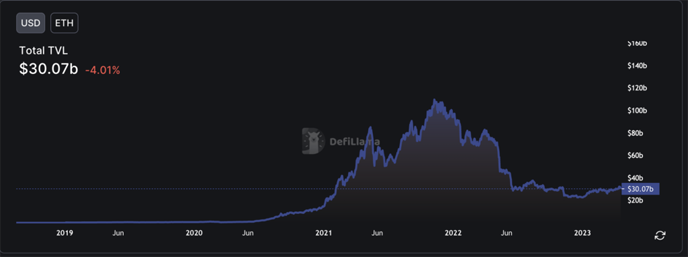

Let’s consider the TVL in the largest network Ethereum. According to DappRadar’s report released on December 21st, 2022, this metric was equal to $32.12 billion. DefiLlama, in turn, gives a totally different number for the very same day. According to this blockchain analytics platform, Ethereum’s TVL ration was equal to $23.58 billion.

DefiLlama: TVL on Ethereum over 30 Billion USD as of April 19, 2023.

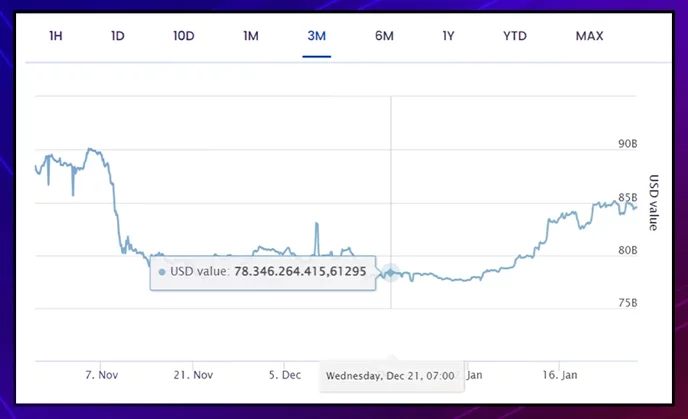

Finally, Stelareum says this number equaled $78.4 billion. An interesting fact is that the shape of its graph resembles the one that DefiLlama shows. Yet, the numbers are almost three times higher.

Other platforms providing such data such as DeFi Pulse, TheBlock, and Nansen give different numbers as well.

Why Calculating Total Value Locked (TVL) is Hard

There are many reasons for that. Generally speaking, it’s the decentralized nature of the crypto market that one has to blame.

With so many blockchains, dApps, and protocols that operate independently from one another, combining all the data into a single report is a really difficult task.

The main reasons for this complexity are as follows:

1. Clones of Blockchain Protocols

Since blockchain projects are in most cases open-source, it makes it pretty easy for a skilled developer to create their clones.

Take Ethereum, for example. The platform itself features only a single separately evolving hard fork, Ethereum Classic. Yet, the number of its clones has long exceeded 10 thousand.

In order to accurately calculate Ethereum’s TVL, data providers have to constantly keep track of all its newly emerging clones and re-evaluate their measurements.

2. Different Values of Locked Assets

The cryptocurrency market is known for its high volatility. In turbulent times, the price of a single asset may drastically change within a single minute, let alone larger timeframes.

Besides, a single asset may have a different price on different platforms. Combined with rapid fluctuations, this factor makes it extremely difficult to give an exact estimate of how much value is really locked within blockchain systems.

3. Different Ways of Locking Value

In addition, there are many different ways for value to be locked in a cryptocurrency ecosystem.

Users may stake their coins in liquidity pools, dApps, or on exchanges. They can lend their assets through dedicated protocols such as AAVE or Compound. Finally, they can lock them in DeFi protocols.

Such an extensive variety of options doesn’t simplify the process of calculating TVL either.

4. Locked Assets Can Be Used Elsewhere

One may assume that if some crypto assets are locked, there is no way to use them anywhere but within a given app or a blockchain. However, this assumption is wrong.

With DeFi, one can create a derivative of a locked asset and reuse it elsewhere. In fact, the process known as rehypothecation makes it possible to use the same collateral in many other apps. This may significantly increase TVL while in reality, the sum of initially locked assets will remain the same.

5. TVL Can Be Easily Manipulated

TVL relies on many factors some of which are prone to manipulations. Here are some examples of how this can be done.

Example 1. A large sum deposited into a small-cap DeFi protocol can make its TVL spike.

Example 2. One may artificially increase TVL via wash trading. This process implies placing buy and sell orders for a specific asset of a DEX simultaneously. In reality, the value will not change hands. Yet, if the DEX uses this data to calculate TVL, the metric will be incorrect.

An anonymous user on the Algorand forum gave a more detailed explanation of how this process works.

Blockchain makes DeFi transparent, that’s true. But there are still many ways to influence TVL ratio through inaccurate reporting or simply through bad actors.

How To Evaluate DeFi Protocols

As you may see, TVL alone cannot show a clean picture. For higher efficiency, it is also worth considering other factors that reflect the health status of a given app.

For example, it’s worth studying the following aspects when you do your research about a given DeFi ecosystem:

- Use case. Investigate what problems the product tries to solve, how well it solves them, and, most importantly, how big its potential audience is.

- Security. Find out if the protocol has ever passed any external security audits. Check if the audit has discovered any security gaps and if the protocol developers have managed to fix them.

- Team. Study the key personas who develop the product, their past experience, and proven track records in the blockchain industry.

- Liquidity. Check how easy it is to buy and sell the assets involved in the protocol.

- Governance. If a protocol has governance, it means the code can be changed. Some projects need code to be changed sometimes, but immutable protocols are far safer than mutable ones.

- Community. Aside from estimating the number of followers, it is also important to evaluate their activity. Believe it or not, it is also possible to artificially increase the size of community with an army of bots.

- Transparency. Finally, check if the project is transparent enough about its code and financial operations.

Closing Thoughts

TVL is surely a useful metric. But as you may see, it does not always reflect the true state of things.

Other less important but still interesting numbers to investigate include the unique address count, market cap, circulating supply, the number and the utility of native tokens, etc. Yet, just like TVL, all these are surface-level metrics.

A wise investor should look much deeper when evaluating a blockchain project. Don’t be fooled by the nice facade and always do thorough research before you entrust your funds to anyone.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant