What is Liquid Staking and How Does It Work?

Liquid staking helps to solve the liquidity problem inherent to PoS-based blockchain solutions. This technology enables crypto holders to mint derivatives and to use them elsewhere while still getting rewards on the original coins at stake.

Read this article to find out more about how liquid staking works, its pros and cons, and what popular liquid staking protocols exist up to date.

Illiquidity: the Key Problem of Staking

Let’s first define the key problem of PoS-based solutions and why it matters at all.

Proof-of-stake is a consensus mechanism created as an alternative to the proof-of-work algorithm. It is designed to eliminate PoW’s disadvantages, i.e. inefficient electricity consumption and the lack of scalability.

To earn passive income, one no longer needs to invest in costly equipment or waste money on electricity. Instead, the size of your crypto rewards depends on the amount of crypto you contribute to the staking pool.

Indeed, PoS has proved to be a much better option.

Still, such an approach has its downsides as well, with liquidity limitations being the most crucial of them all.

Whenever you stake your digital assets, you have to lock them for a specified period of time. During this time, you can’t use them elsewhere. As a result, the capital efficiency of your funds decreases.

Some centralized exchanges offer alternative staking solutions that eliminate this problem. However, such custodial services represent even greater evil as they deprive their users of their ownership rights with all the ensuing consequences.

What is Liquid Staking?

Liquid staking refers to a mechanism that allows individuals to stake their cryptocurrencies in a blockchain network while also maintaining liquidity and access to their staked assets.

Traditionally, when users stake their tokens, they lock them in a smart contract for a specific period to support the network's security and consensus.

However, with liquid staking, users can receive staking rewards and simultaneously utilize their staked tokens in other financial activities such as trading, borrowing, and lending.

This concept enables stakers to maximize the potential of their assets by unlocking liquidity and participating in decentralized finance (DeFi) applications while still contributing to the underlying blockchain network's security.

Unsurprisingly, this new approach has quickly gained popularity.

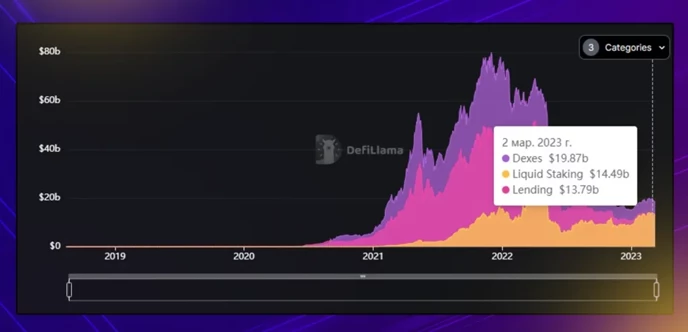

The total value locked within liquid staking protocols has grown from about $500 million USD in March 2021 to more than $14 billion 2 years later. What’s more, it even surpassed DeFi lending, having become the second-largest crypto sector.

How Does Liquid Staking Work?

To get a better understanding of the process, let’s break it down into a step-by-step scenario.

Assume Alice holds some ethers. She doesn’t plan to spend it anytime soon, so she decides to put them at stake so as to earn passive income.

At the same time, she wants to have the possibility to access her funds whenever she wishes. A liquid staking protocol is the best solution to meet her requirements.

Here’s what happens next:

- Alice stakes ethers in the liquid staking protocol.

- She receives 1 stETH (staked ETH) for every ETH token at stake.

- As her original ethers remain staked, she continues earning her staking rewards.

- At the same time, she can use the newly created derivative tokens for trading, staking, or any other purposes.

Thus, she gets a chance to increase her profits further.

In order to get back her original funds in the future, she will have to return the same amount of stETH to the protocol.

Advantages of Liquid Staking

The techniques offered by liquid staking are not new. The participants of the TradFi market have long been using similar methods for a variety of purposes.

Thanks to blockchain, this process is now much more secure and transparent. At this, liquid staking provides its users with the following benefits.

1. Immediate liquidity

As mentioned earlier, the lack of liquidity is one of the key disadvantages of many DeFi protocols.

By locking funds in DeFi protocols, crypto holders lose the possibility to use their funds before the staking period runs out. Liquid staking provides liquidity to the staked funds and enables their holders to cash them out at any time in case of emergency.

2. Higher ROI via yield farming

Yield farming refers to the process of generating income by locking crypto funds in DeFi protocols. Liquid staking makes it possible to increase this income further.

By creating liquid staking derivatives, one can put them at work somewhere else and double the profits.

3. The reduction of validators’ risk

Traditional staking implies delegating tokens to a single validator who gains a share of rewards for supporting the infrastructure.

Validators usually don’t have custody over delegated funds. Yet, they may still fail original token holders.

For example, if validators experience long downtime or misconfigure their hardware, the tokens may be taken away by the blockchain.

With liquid staking, tokens are distributed across many validators which significantly reduces the risk of such losses.

4. Lower requirements for node validators

In order to become a node validator within the Ethereum ecosystem, one has to stake 32 ETH. For the majority of crypto investors, this is a pretty large sum of money that is difficult to obtain.

Some of the liquid staking providers reduce this amount and thus make the whole enterprise more affordable.

Risks of Liquid Staking

The advantages of liquid staking are indisputable. Still, there are also some serious risks that traders and investors should be aware of.

1. Collateral’s devaluation

Yield farming is without a doubt quite a risky business. Unless you hold only stablecoins at stake, there is always a risk of liquidation should the collateral value go down.

Leveraging leads to even higher risks and may result in the liquidation of all assets. Proper market research can help to bring these risks to a minimum.

2. Reduced liquidity of original tokens

Liquid staking makes funds more accessible, but this advantage comes at a cost of original tokens’ liquidity. How so?

Whenever someone mints staked tokens, the circulating supply of original tokens goes down by the corresponding amount. Thus, their liquidity suffers which may have a negative effect on those who hold significant sums of these tokens in their portfolios.

3. High centralization

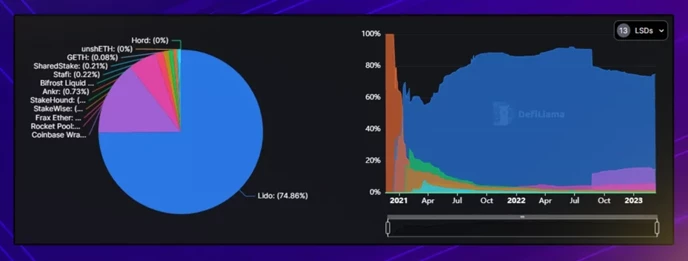

Although liquid staking contributes to higher decentralization of the crypto market as a whole, it remains pretty centralized itself.

At the time of writing, nearly ⅔ of all the funds locked in Ethereum-based liquid staking protocols reside on a single platform, Lido. Such a high level of centralization may result in heavy losses should the protocol get hacked.

4. The price difference between stETH and ETH

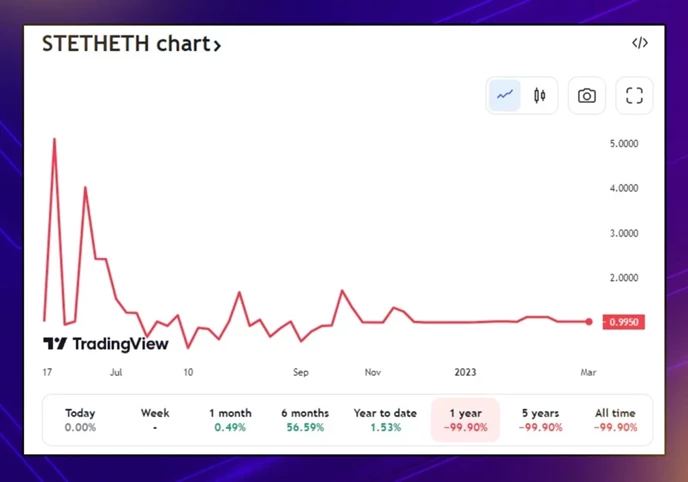

Coinbase research released in June 2022 revealed that from January to May, stETH was trading at an average 2.2% discount to ETH. Thus, traders had to pay extra in order to get their ethers back.

The report blames liquidity and other risks for such disparity. Also, it assumes that the gap will decrease in time as the market will mature.

This assumption seems to be true. Nine months later, in March 2023, the difference between assets’ prices already made up only 0.5%. Still, even such a small gap may be a problem when large amounts of crypto are concerned.

Most Popular Liquid Staking Services

The liquid staking market sector still remains in its nascent stage. Yet, there are already a few options to choose from.

Some of the most popular liquid staking platforms are listed below.

Lido Finance (LDO)

Being one of the most popular liquid staking services in the market, Lido Finance has the highest TVL across all its competitors.

For every ETH staked within the protocol, Lido issues stETH that users can further use for their own purposes.

The token has a high trading volume. At this, one can easily cash it out both on centralized and decentralized platforms like Huobi or Uniswap.

High popularity has its downside as well. In case Lido gets a hold of more than 33% of all ethers, it may cause a centralized attack on the whole network.

Rocket Pool (RPL)

Rocket Pool offers a much more affordable solution for those who want to become node validators.

First, it enables anyone to run an RPL node, unlike Lido which only offers this option to LIDO holders. Second, it requires validators to stake only 16 ETH, i.e. twice less in comparison with Ethereum.

Lower requirements for network validators, in turn, increase the risks of malicious actors dominating the system.

To safeguard the platform, Rocket Pool also requires validators to deposit its native token RPL for the sake of insurance against malicious behavior. At this, the minimum value of RPL should be equal to 10% of the staked Ethereum.

Bottom Line

The crypto market continuously evolves offering new ways of making passive income to its participants.

Liquid staking indeed represents an important milestone. It enables cryptocurrency holders to gain immediate liquidity on the funds they keep at stake. At the same time, a high level of centralization makes this method of making money less secure.

Yet, new solutions are sure to emerge and make the new approach more decentralized.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant