Fiat-Backed Stablecoins: The Opposite of Why Crypto Was Invented?

What are Fiat-Backed Stablecoins?

Fiat-backed stablecoins are cryptocurrencies that are designed to maintain a stable value by being backed or pegged to a fiat currency, such as the US dollar or the euro.

These stablecoins are typically backed by reserves of the corresponding fiat currency held by a centralized entity, such as a bank or a financial institution.

The purpose of pegging the stablecoin to a fiat currency is to provide stability and reduce the price volatility often associated with other cryptocurrencies like Bitcoin or Ethereum.

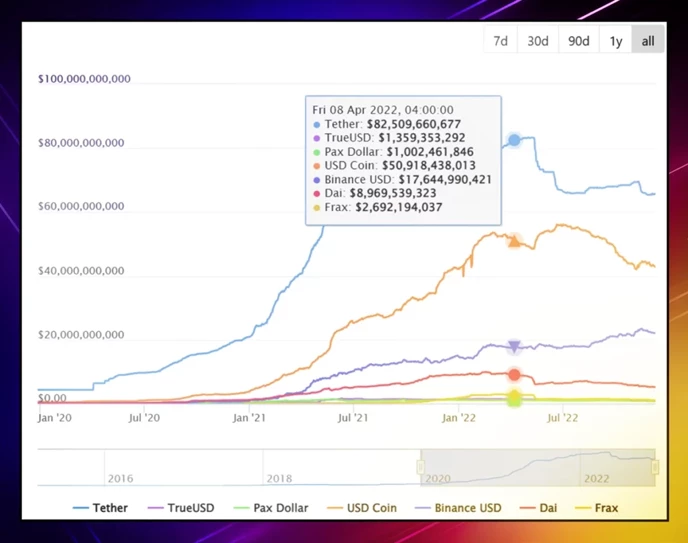

At the time of writing, fiat-backed stablecoins have a market cap above 120 billion USD and provide the cryptocurrency ecosystem with liquidity and economic energy.

How Do Fiat-Backed Stablecoins Work?

First things first, let’s clarify how these assets work.

There are several ways for stablecoins to maintain a stable peg. Those that are backed by fiat currencies rely on the financial reserves of the issuing company.

In short, the process of issuing new coins looks as follows:

- A user sends some fiat currency to the company’s bank account.

- The company mints digital assets of the same value on the blockchain.

- Then it sends this sum to the user’s crypto wallet.

Thus, the number of digital assets in circulation always equals the sum of money stored in the company’s vault. The real rate may slightly fluctuate. But it rarely exceeds 1-2%.

Such a company may easily fall into the temptation to mint more coins than it has in the reality. Yet, it can hardly ever do so. Financial watchdogs stand on guard and constantly audit the activities of such organizations.

Risks of Fiat-Backed Stablecoins

Alright, so there are higher authorities that scrupulously monitor these companies and bring down the counterparty risk to the minimum. What would be the biggest pitfalls of using such currencies then?

First, there is a risk of censorship.

Bitcoin was invented in the first place to stand against the censorship of central banks that issue fiat money. Yet, fiat-backed stablecoins do exactly the opposite. For example, central parties standing behind these coins may block specific addresses on a whim.

Thus, just a few months ago, Circle froze blacklisted Tornado Cash smart contract addresses totaling $437 million worth of assets.

Dai of Maker DAO runs a similar censorship risks since the majority of its collateral is USDC.

A more recent case involves Tether that blacklisted $31 million worth of USDT following the alleged FTX hack.

Of course, the hackers that stole all those funds were up to no good. But be sure that law-abiding citizens have suffered from these actions together with the criminals.

Next, such coins lack transparency.

The aforementioned Tether has many times faced accusations of dirty games. Audit or no audit, when you are the largest player in the market with the money-printing power, getting around the law becomes a much simpler task.

Since there is no way to verify operations with fiat currencies on a public ledger, the problem of opacity is something to consider.

Finally, there are problems with redeeming stablecoins.

Users may face problems when trying to convert such assets to cash and cash equivalents.

For example, Tether obliges its users to pay $150 for verification to be able to cash out their digital assets. Besides, the minimum size of the transaction equals $100,000. Such a sum can become a real obstacle for regular users.

Fiat-Backed Stablecoin List

At the time of writing, the full list of stablecoins includes a few dozen of assets. The number of the most popular options is much smaller, though. Let’s review the fiat-backed stablecoins with the highest market cap.

USDT

- Issuing organization: Tether

- Launched year: 2014

- Auditing agency: Sporkin, Sullivan LLP, Freeh, BDO Italia

The Hong Kong-based company Tether issued its first stablecoin USDT in 2014. This is one of the first and the most reputable stablecoins that has lived through thick and thin.

Tether has become the first coin of its kind to combine the benefits of both cryptocurrencies and fiat. It has provided its users with the possibility to transfer value at a low cost in a fast and transparent manner.

What about Tether USD coin’s compatibility? Initially launched on the Ethereum network, it has added the support of other blockchains over the following years. At the time of writing, it operates on Bitcoin, TRON, EOS, Algorand, and many other protocols.

Many rivals have emerged over the past few years. Yet, Tether’s market capitalization remains the highest.

USDC

- Issuing organization: Circle and Coinbase

- Launched year: 2018

- Auditing agency: Grant Thornton

USD Coin, or shortly USDC, is another popular fiat-collateralized stablecoin with a peg to the US dollar. The Centre Consortium standing behind its creation was co-founded by a reputable cryptocurrency exchange Coinbase and a financial technology company Circle.

Just like Tether, it supports a number of different blockchains such as Ethereum, TRON, Binance Smart Chain, and Solana. However, unlike Tether, it has never been accused of any dirty games and has a spotless reputation.

BUSD

- Issuing organization: Binance

- Launched year: 2019

- Auditing agency: Withum

Launched by the world’s largest cryptocurrency exchange Binance together with Paxos, Binance USD represents a stablecoin pegged to the US dollar. The coin emerged as a part of Binance’s strategy to increase the mass adoption of cryptocurrencies worldwide.

BUSD is subject to regular crypto audits as it follows the regulatory framework of the New York State Department of Financial Services (NYDFS).

Initially launched as an ERC20 token, BUSD also is also compatible with the BEP-2 technical standard.

Bottom Line

Stablecoins play an important role in the crypto industry. They make prices more predictable, reduce overall volatility, and truly contribute to the mass adoption of new technology.

Yet, one cannot turn a blind eye to the problems of fiat-collateralized stablecoins.

Digital assets should not be censorable. At the same time, stable assets should be fully backed to ensure their value and they should be redeemable by anyone, anytime.

Luckily, aside from fiat-backed assets, there are other types of stablecoins that solve these problems. For example, crypto backed stablecoins fully rely on other digital assets such as PulseChain.

The Liquid Loans protocol offers a a decentralized, admin key-free, full-backed stablecoin on PulseChain called USDL.

Learn more about USDL here.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant