How is 0% Percent Interest Possible? (Crypto Loan 2024)

You know the TV ads you see all the time offering “24 months interest free” on whitegoods and furniture? Those offers are actually sneakier than you may realize, for two reasons.

Firstly, the retailers who offer these services usually don’t tell you that you’re actually taking out a credit card, typically with a very high interest rate if you default on your payments. And secondly, they’ll never tell you that the interest is actually built into the purchase price.

Why are we telling you this? Because we want you to know that Liquid Loans is nothing like these services. In fact, using Liquid Loans is much more like taking out a Home Equity Line of Credit (HELOC) as you are collateralizing a valuable asset in order to extract value from it in the form of a loan.

However, unlike a HELOC, Liquid Loans charges no interest whatsoever. Read on to learn how this is possible.

No ongoing overheads

Once deployed, the Liquid Loans smart contract will essentially just be a piece of immutable code that lives on the blockchain. There’s no office space we need to pay for, no electricity costs, no staff to keep it running. Just unchangeable, un-switch-off-able code on the internet.

You may be wondering, if there are no ongoing overheads in running the protocol, then why does Liquid Loans need a sacrifice phase? The answer is that you should have absolutely no expectations of profit from the work of others. If, however, Liquid Loans decided to use some of the funds it receives from any sacrifice phase for marketing to help drive adoption in the future, then that could maybe seem like a reasonable use of the funds. Of course, there is no telling whether or not that will happen, and you should have no expectations.

Non-custodial collateralization

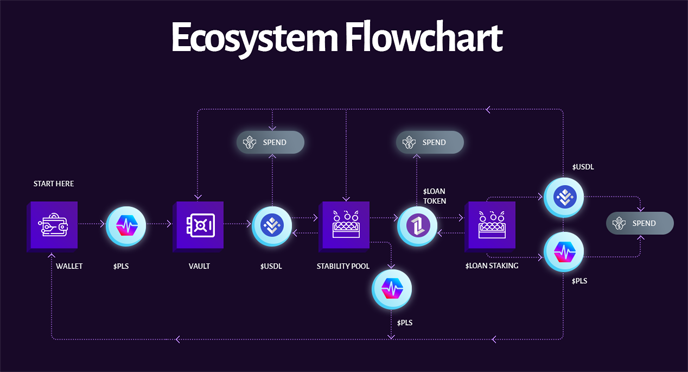

With Liquid Loans, when you choose to mint USDL against your PLS, you and you alone are performing that operation – with the understanding that if your Vault level ever slips under 110% collateralization, you risk losing your PLS.

Although Liquid Loans has a low 110% minimum collateralization ratio, we recommend most first-time users set a very high collateralization level – above 500%, for example – until they are thoroughly familiar with the protocol and how the system works.

Please note that liquidations can sometimes be a very good thing as they can act as a stop loss, but using the system in this way is for experienced users only.

Algorithmic stablecoin (say what now?)

Thanks to some very clever code, our algorithmic stablecoin USDL is always redeemable for one US Dollar worth of Pulse. So if the price of PLS is $0.1, one USDL will be redeemable for 10 PLS. If the price of PLS is $0.01, then one USDL will be redeemable for 100 PLS. This helps to ensure that the system remains solvent at all times.

Powerful incentives

With Liquid Loans, all the stability and liquidity in the protocol is provided by the users. In order to incentivize people to provide stability and liquidity, there are healthy rewards for taking part.

To be a stability provider, all you need to do is add USDL to the Stability Pool, and you’ll receive gains in (discounted) PLS from liquidations and receive rewards in the form of LOAN tokens as well. To get your hands on USDL in the first place, you simply mint it by collateralizing your PLS, or buy USDL on the open market.

LOAN staking

LOAN is the native token in the Liquid Loans protocol. It exists in order to provide Stability Providers with enough incentive to provide stability, but that’s not to say it’s not a significant earner in its own right.

Stability providers can, of course, sell the LOAN token they receive if they want to, or they can stake it in the Staking Pool. LOAN Token Staking has its own rewards – LOAN stakers earn a pro rata share of the system’s borrowing and redemption fees in USDL and PLS proportional to their size in the Staking Pool.

So if you’re a stability provider and a LOAN staker, then you’re really using the Liquid Loans system like a pro.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Connor

Connor is a US-based digital marketer and writer. He has a diverse military and academic background, but developed a passion over the years for blockchain and DeFi because of their potential to provide censorship resistance and financial freedom. Connor is dedicated to educating and inspiring others in the space, and is an active member and investor in the Ethereum, Hex, and PulseChain communities.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant