Fake Trading Volume, And How To Recognize It

Take a guess at how much crypto is ‘fake’ trading volume? 20%, 50%, 80%?

Analysts estimate that at least 50% of Bitcoin volume is fake or non-economic. It seems over a hundred exchanges are trying to inflate trading volume to lure in investors. Only about a dozen centralized exchanges might have actual volume.

In 2019, Bitwise reported to the SEC that 95% of all crypto was fake volume. That means, if CoinMarketCap shows $20B of 24h global volume, it’s more like around $1B. This led many investors to overestimate markets and buy tokens that no longer exist.

But how can you recognize fake volume and make better decisions? Let’s find out.

Quick Takes:

- Most crypto volume is fake because of wash trading, bots, slippage, and lack of exchange transparency.

- Only ten exchanges have actual volume. Tokens with fake volume tend to only trade on DEXs, concentrate token supply, and make too many transactions per holder.

- Both centralized and decentralized exchanges can be manipulated. While they can be blacklisted or regulated, there’s no effective prevention to fake volume in crypto.

Why Fake Trading Volume?

Market volume is associated with interest and demand. High token volume points to price volatility and trading opportunities. When it comes to exchange volume, it means high liquidity and social proof.

Nobody wants to buy a token making $20k/day unless you really know the project.

And besides, platforms that fake crypto volume are more likely to bring real traffic and eventually stop faking it. There are too many incentives and not enough ways to prevent it. But what does it mean to the everyday crypto investor?

- Scam projects get unwanted attention

- Investors don’t have reliable data to make decisions

- Exchanges that fake volume may also lack transparency about spreads, reserves, and consumer debt. Not only does this affect every token listed, but they also facilitate (illegal) wash trading.

This problem hasn’t gotten any better in 2023 since the Bitwise report. Market caps are already a vanity metric. Could the same happen to trading volume?

3 Ways To Fake Crypto Volume

Fake trading volume doesn’t require as much knowledge as you may think. You just need to have enough tokens, someone who does, or an exchange that rewards volume. The most common methods are:

Wash Trading Services

Some traders have made it a business to fake trading volume for new projects. For a few thousand dollars, small exchanges and tokens can multiply their market volume in no time. (Here’s how they do it)

Curiously enough, IRS wash sale rules don’t apply to cryptocurrencies. Because they’re virtual property and not securities, developers can design trading bots to take advantage of this loophole. At least until it’s corrected on future regulations.

In case regulators couldn’t prevent wash trading, they would probably impose penalties on whatever exchanges were caught faking volume. Besides those legal “costs,” it’s inexpensive to automate wash trading.

Pump and Dump Groups

When traders organize together to manipulate crypto prices, they form “pump and dump” groups. The strategy is to collectively buy one coin to raise its price and sell it before others do. Sometimes, prices spike by 10x and return to all-time lows within seconds.

Hundreds of users join hoping to make quick profits. But they often lose because of the way it’s organized by the insiders (“the whales”):

- The whales look for the best coin to pump and accumulate it gradually to avoid price impact.

- Once accumulated, they reveal the coin to the groups weeks later. Everyone buys it and exits as it pumps.

- Seconds later, when the whales take profits, prices start falling. The earliest and fastest traders profit at the cost of other members’ losses.

Whatever the last price is, all this trading volume can mislead other investors to this token.

Exchange Manipulation

As a token creator, exchanges are the easiest way to fake volume. Some of them encourage it by creating trader competitions and volume incentives. And while those rewards aren’t a money cheat code, they’re enough to inflate millions in trading volume.

Also add the possibility of the exchange trading against itself, with either wash trading services or their own software.

Exchanges can also manipulate volume with fees and spreads. The average spread of verified exchanges is either a flat fee below $1 or <0.1%. Smaller exchanges can have spreads over 1% and have as much volume as Coinbase.

These differences add up quickly after thousands of daily trades.

How to Recognize Fake Trading Volume

Fake volume can be as confusing as recognizing bad projects in a bull market. The good news is, you don’t need to wait for them to crash to find out. There are five signs that point to artificial volume:

Too Many Transactions per Holder

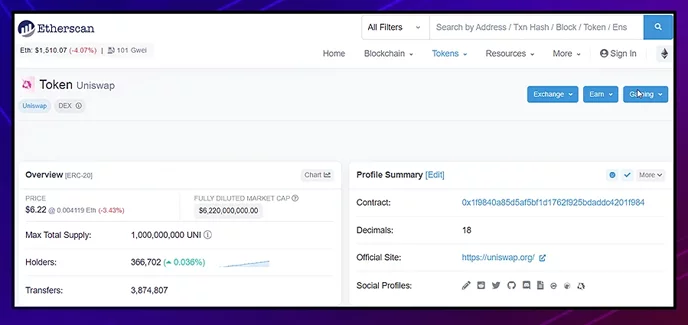

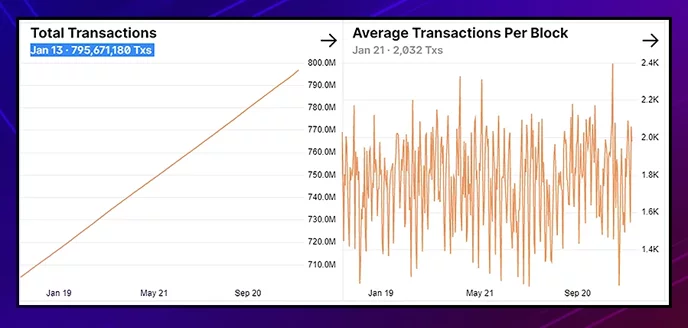

The average holder of any major cryptocurrency makes about ten transfers. That means if there are 10,000 holders, there will be ~100,000 transactions. You can find this curious relation on major tokens like Polygon, Aave, and Uniswap.

Even Bitcoin:

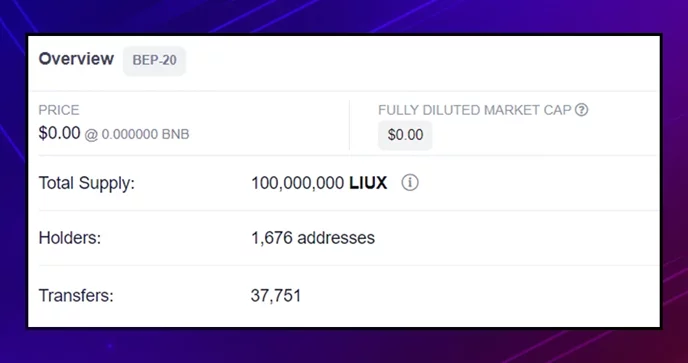

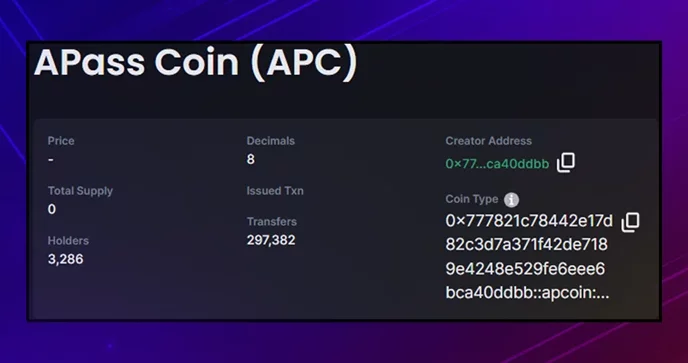

This 1:10 proportion is especially important when there’s barely any transaction history or holder quantity. You can see, for example, how these other sh*tcoins go against that pattern:

Indeed, we later found that over 90% of those transactions happened in the past few days.

If the average holder is swapping the token dozens of times within such a short time, there’s probably market manipulation going on. At least, on Ethereum and BnB Chain. If the project belongs to more scalable networks, there will be exceptions.

Concentrated Token Supply

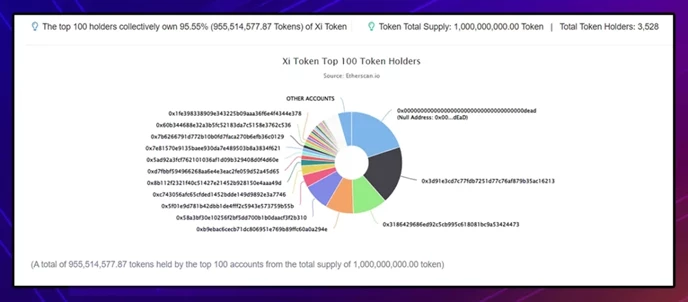

When looking at the top ERC-20 tokens, about 80% of the total* supply goes to 100 wallets. While this sounds very centralized, oftentimes the tokens go to smart contract wallets and treasury funds. Excluding those “wallets,” the actual top 100 users own well below 50%.

One reason fake volume is more common on new projects is that they average +95%:

How easy is it to fake crypto volume when just ~100 wallets own most of the supply? Maybe a dozen of those wallets belong to the same person. Maybe smart contracts are vulnerable by design, or the founder has the admin keys.

Not only do the owners fake trading volume but also wallets to make it seem like there are more holders. That’s another reason for the +95% token ownership.

Dormant Projects Suddenly Have Great Demand

Anytime, you can find new projects that surge +100% overnight. All you have to do is visit pages like CoinMarketCap and sort by the biggest gainers. If you take a closer look, however, most of them are far from innovative:

- Memecoins

- Me-too DeFi tools

- DAO governance tokens

- Play-to-earn tokens… without a game

Along with bad tokenomics, it’s no surprise that these “projects” “take off.” The market cap might be several million, but the 24h volume is five figures, and the Top 10 holders keep +90% of the tokens. Prices will drop as soon as they rise.

And they only did to lure in speculators.

It Doesn’t Trade on Common Exchanges

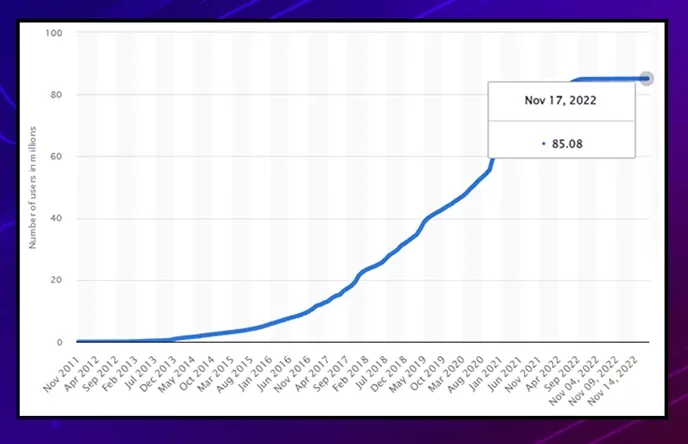

If only ten custodial exchanges have real volume, what does that mean for decentralized* exchanges (DEXs)?

As for 2023, there are about as many DEXs as CEXs. The former type has lower liquidity and higher spreads, making fake volume a bigger problem.

Sometimes, the same developer creates the suspicious token and DEX where it trades.

Uniswap and PancakeSwap have the most trading volume, but mind that anyone can trade any tokens on DEXs. That’s where most rug-pull projects fake their volume. Only CEXs like Binance and Coinbase have a token approval process.

Smaller CEXs like OKX may be more flexible because they need volume to attract users and compete with market leaders. Hence another opportunity for fake volume.

The Market Cap and Volume Don’t Make Sense

Market cap is a vanity metric that’s often confused with investors’ interest. All it is is the token price multiplied by the token supply— which the owner may manipulate. Wash trades, along with a high token supply, can pump prices over 100% within 24 h with just a few thousand dollars. Briefly.

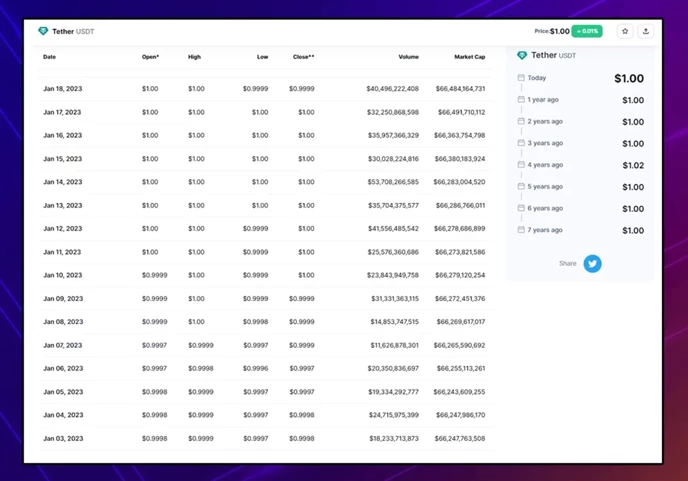

The real market interest is the average trading volume. For some reason, coin-tracking websites don’t include this (unless you use Glassnode, Messari, and such). On CoinMarketCap, you can get a general idea from the Historical Data tab:

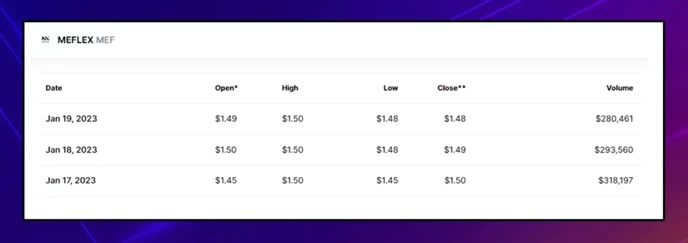

For example, USDT averages at least $20B per day, sometimes over the market cap. Assuming it’s not fake volume, it means USDT is pretty liquid. By contrast:

This token has no history and barely averages $300K. The market cap? $1.48B.

Is There a Way to Stop Fake Crypto Volume?

Given how long fake volume has been around, it’s not going to be easy or quick to get rid of it. Blockchains are becoming faster and cheaper, crypto wallets are available everywhere without KYC, and anyone can create coins or NFTs. It’s never been easier.

The fake volume will exist, at least, as long as it works. If there were tools for people to easily avoid such traps, they would starve scammers of resources. Those tools are decentralized oracles, block explorers, crypto audits, and exchanges with low spread and proof-of-reserves.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Max

Max is a European based crypto specialist, marketer, and all-around writer. He brings an original and practical approach for timeless blockchain knowledge such as: in-depth guides on crypto 101, blockchain analysis, dApp reviews, and DeFi risk management. Max also wrote for news outlets, saas entrepreneurs, crypto exchanges, fintech B2B agencies, Metaverse game studios, trading coaches, and Web3 leaders like Enjin.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant