What is Metcalfe's Law and How Does It Relate to Blockchains?

They say you can’t have too much of a good thing. Perhaps that’s what Ethernet inventor Bob Metcalfe was thinking about when he crafted something called Metcalfe’s Law. It’s a principle of “network economics” in telecom and computer networks that came about in the early 1980s.

It has to do with the number of nodes in a network. Basically, a network’s value is related to the number of nodes in that network. Nodes, whether computers, servers or users, is actually the Latin word for knot. So if you could visualize all sorts of endpoints on the network — computers, phones, individuals, airports, etc. — originating from the knot.

In this article, we’ll explore the meaning of Metcalfe’s Law and evaluate how it relates to blockchains.

What is Metcalfe’s Law?

Metcalfe’s Law says that the value of a network is directly proportional to the square of the number of connected users, or nodes, in that system. By adding a user to a network, the number of connections rises in direct proportion to the square of the number of users.

Node connectivity is key. Let’s say we have 10 nodes in a network. To determine its value, use the equation of 10x10 to get a value of 100.

Metcalfe’s Law was paired with Moore’s Law, which suggested that the number of transistors on microchips would grow twofold every couple of years.

Metcalfe’s Law also harnesses a phenomenon known as a network effect, where the value of a product like the blockchain is strengthened as the number of people using it grows. The more people that are using the network, the stronger the network becomes.

In the eighties, they didn’t have the internet. So the law was relevant to attach a value on a device (see fax machine example.) However, Metcalfe’s Law has stood the test of time and is now applicable to the growth of the internet and other technology, including blockchains.

Basically, there is strength in numbers. A single network by itself is not very useful because it can’t connect to itself. One way to visualize Metcalfe’s law is to think of an historical example like a fax machine. One fax machine is not very useful by itself. But the more fax machines that are connected to a network, the more valuable that fax machine becomes. That’s the basic idea of Metcalfe’s Law.

While Metcalfe’s law bears Bob Metcalfe’s name, the wheels for this law were originally set in motion by fellow inventor George Gilder.

Metcalfe’s Law Examples

Even though Metcalfe’s Law was created for computer networks, it could be applied to just about any type of system you could imagine, even nature and religion. Let’s take a few of the more common examples.

Social Media Influencers: Let’s take Kim Kardashian. So the bigger the network of a social media influencer like Kardashian, the more connection points that will exist among people and places, thereby increasing the value of this celebrity.

Facebook: Social media platforms like Facebook are also a good example of network effects. Clearly each new user who joins Facebook affects the users who are already using it, bolstering the value of the network. The value of this platform increases as more people join. Facebook, with some 2.9 billion users, is a good example because it is a platform where users look to connect with other users.

You could call it a fear of missing out; no single user wants to miss out on what their connections are talking about. Even Mark Zuckerberg has admitted, “I think that network effects should not be underestimated with what we do.” The same could be said for Twitter, Instagram, etc. After all, humans are social beings and are designed to be connected with one another.

Rideshare: You could also group rideshare platforms like Uber and Lyft under Metcalfe Law examples. The more drivers and passengers who sign up for these apps, the greater the experience is likely to be for all involved. Therefore the value of this network grows exponentially as it grows.

Metcalfe’s Law and Bitcoin

Metcalfe’s Law continues to stay relevant as time goes on. The emergence of the blockchain and cryptocurrencies has proven the law’s ability to stay relevant even as technology evolves. Bitcoin, the maiden blockchain to come on the scene, is a good example of this.

Similar to the previous example of the fax, Bitcoin would never have attained its valuation if its creator, Satoshi Nakamoto, were the only node on the blockchain. As the number of nodes has increased, so too has the value of the Bitcoin network. As of March 2023, the number of Bitcoin nodes has neared 16,150, according to Bitnodes.

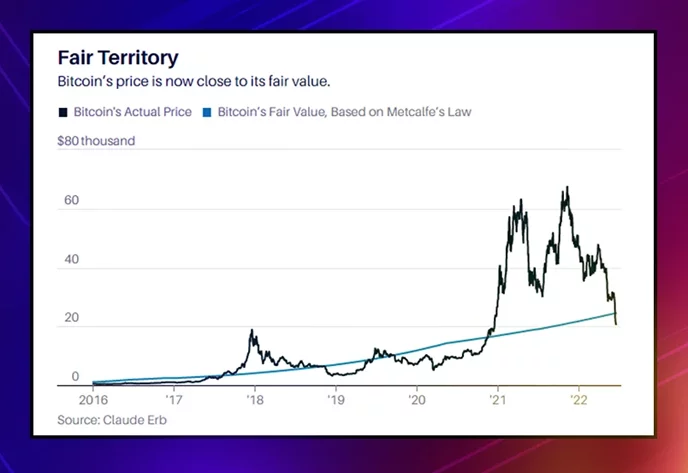

However, bitcoin is an extremely volatile asset. The BTC price was hovering at around $25,000 as of March 2023 compared to an all-time high of close to $70,000 per BTC in November 2021.

Spencer Wheatley at ETH Zurich in Switzerland alongside some of his colleagues published a research paper on network theory and bitcoin’s value, in around 2018. They rely on a “generalized Metcalfe’s law” using network properties to make their point.

While Metcalfe used a square of the number of users, the ETh Zurich crew relied on a mathematical expression of 1.69. They emphasize that the way to measure the value of cryptocurrencies like bitcoin is by the network of people using them.

The researchers also point to periods of time when the bitcoin price was trading in a bubble, identifying several instances (2011, 2012, 2013 and 2017) in which the bitcoin price ballooned in value only to pop afterward. After the crash of 2017, their “Metcalfe-based analysis” suggested bitcoin’s support levels would justify a value of $22 billion-$24 billion, “at least four times less than the current level” at the time, they concluded.

More recently, the very same law suggested that the bitcoin price was trading below its fair value. This is based on a separate set of research by analyst Claude Erb cited by Barron’s. According to Erb, every mined bitcoin is good for one user on the network.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Gerelyn

Gerelyn is a financial journalist who has been covering Wall Street for more than 20 years. After reporting for some of the top trade publications on investment banking, infrastructure and retirement, she was drawn to decentralization and shifted her coverage to the blockchain and cryptocurrency space in mid-2017. Since then, she has contributed to several major Bitcoin, Blockchain, and DeFi news sites, and has also written a children’s book.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant