Unlock the Hidden Secrets Behind Crypto — VisitTheCoinZone.com!

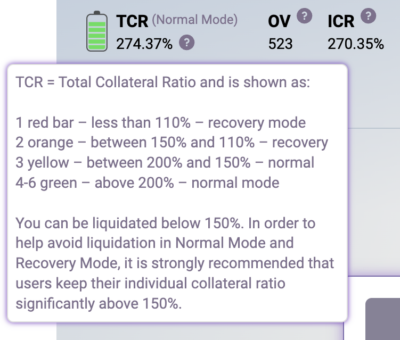

A liquidation happens when a vault's collateral ratio falls below 110% (in normal mode) and 150% (recovery mode).

To avoid liquidation:

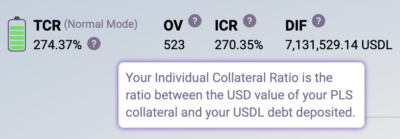

- Know the Individual Collateral Ratio (ICR) of your vault

Your ICR is located on the top left of the Liquid Loans Dapp.

It is the percentage of PLS value over USDL debt.

Understanding your collateral ratio is key to avoiding liquidation.

VERY SAFE - If your ICR is 1000%, this means you can withstand a ~90% drop without getting liquidated.

SAFE - If your ICR is 500%, this means you can withstand a ~80% drop without getting liquidated.

RISKY - If your ICR is 200%, this means you can withstand a ~45% drop without getting liquidated. - Understand the total collateral ratio (TCR) of the protocol

The TCR is located on the top left of the Dapp. It is the percentage of total PLS value across all vaults over the total debt across all vault in the protocol.

Understanding TCR is key to avoiding liquidation.

When the TCR of the protocol falls below 150%, Recovery Mode kicks in.

During Recovery Mode, all vaults under 150% are liquidated until the TCR returns to normal mode.

If you choose a risky ICR, make sure to monitor the TCR so you don’t get caught off guard by recovery mode. - Monitor your vault

Arguably, the one most important part of avoiding liquidation is constantly monitoring your vault and the price of PLS.

If the price of PLS falls, it lowers your ICR.

If your ICR is lowering towards 150%, you want to have a plan in place to increase your ICR.

You can do this by (1) adding more PLS to your vault or (2) repay some USDL to decrease your debt.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant