How To Generate Healthy Crypto Passive Income (2024)

There are hundreds of strategies for generating passive income in crypto, but the vast majority include taking on high amounts of counterparty risk.

Even if you haven’t been in crypto very long, you’ve probably come across the phrase ‘Not Your Keys, Not Your Coins’.

It comes from the fact that, if your crypto is held on a centralized exchange or a Staking-as-a-Service platform with admin keys, you really don’t have ultimate control over it – even if it seems like you do.

In the event of the exchange or staking platform getting hacked – or conveniently being ‘down for maintenance’ when you want to withdraw your coins at a time that doesn’t suit them – there’s nothing you can do, because you’re not in control of the keys. And being at the mercy of third-parties isn’t what cryptocurrency is all about.

But thanks to some amazing innovations in DeFi over the last couple of years, it’s now possible to generate very healthy passive income with very little risk. Sounds too good to be true? Read on.

Liquid Loans – the community bank

If you went down to your local bank and told the branch manager you could easily earn returns in excess of 30% APR with next to no risk, they probably wouldn’t believe you.

That’s because legacy financial institutions are used to having shareholders who expect to be paid, as well as big overheads, which make such high returns untenable. In contrast, true DeFi lending protocols like Liquid Loans have no ongoing overheads – they are essentially just a piece of un-turn-off-able, unchangeable code on the internet.

Once deployed, the code can never be edited, making it ‘immutable’, but this can be something of a double-edged sword. On one hand, it’s good that no-one can go in and make changes to the code to syphon money away from the users (for example), but on the other hand, if there was to be a bug or exploit in the code, there’s no way to fix it.

This is why true DeFi protocols like Liquid Loans have to absolutely nail their code before it’s deployed, and why audits are so essential.

Side note: The Liquid Loans protocol will be professionally third-party audited and the full report will be made publicly available before deployment. Read more about our upcoming audits here.

Generating passive income

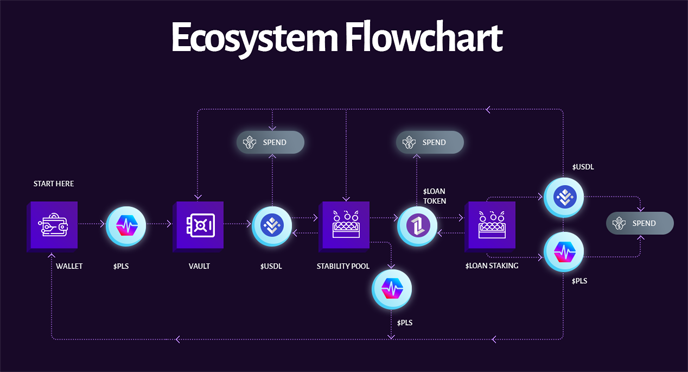

There are two ways to generate passive income inside the Liquid Loans protocol – by taking part in the Stability Pool and by taking part in the Staking Pool. Let’s take a look at the two and how they differ, and the potential rewards on offer.

Providing Stability

When you add your USDL (the native Liquid Loans stablecoin) to the Stability Pool, you are helping to provide solvency to the system. In return, the system rewards you daily in the form of LOAN tokens (proportional to your size in the Stability Pool) and PLS whenever liquidations occur.

Possible returns for taking part in the Stability Pool are known to be approximately 10% – 30% APR.

Staking LOAN

Staking your LOAN token in the Staking Pool is a big help to the system as the Staking Pool provides the necessary incentive tokens that makes stability providing attractive.

In return for staking your LOAN, the system rewards you daily in the form of USDL (proportional to your size in the Staking Pool) and PLS from redemptions.

Possible returns for taking part in the Staking Pool are known to be approximately 20% – 40% APR.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Connor

Connor is a US-based digital marketer and writer. He has a diverse military and academic background, but developed a passion over the years for blockchain and DeFi because of their potential to provide censorship resistance and financial freedom. Connor is dedicated to educating and inspiring others in the space, and is an active member and investor in the Ethereum, Hex, and PulseChain communities.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant