Crypto Scam Wicks on Binance: Avoid Getting Rekt Margin Trading

Navigating the cryptocurrency space can be like a minefield for new investors.

Scammers, hackers, rugpullers, and middlemen all trying to take your hard earned money.

One such method that is commonly observed in use by scammers and/or centralized exchanges are crypto scam wicks.

What is a Crypto Scam Wick?

A crypto scam wick happens when a centralized entity or an individual trades a cryptocurrency at a price significantly outside of its normal trading range with the intent of triggering liquidations or stop loss orders. As a result, a cascade of buys/sells will occur, further pushing the price in the direction that the scammer intended.

Although crypto scam wicks do not have a clear definition, they tend to have similar characteristics:

- Violent price move to the upside or downside, outside of normal price range

- After the violent price move, the price returns to the normal price in a short period of time

- The price usually is only seen across one exchange, suggesting a local price feed issue and centralized ‘bad-acting’

In order to better grasp this important crypto concept and protect ourselves from devastation, we must understand candlestick charts, stop losses, leverage trading, and past examples of scam wicks.

What is a Candlestick Chart?

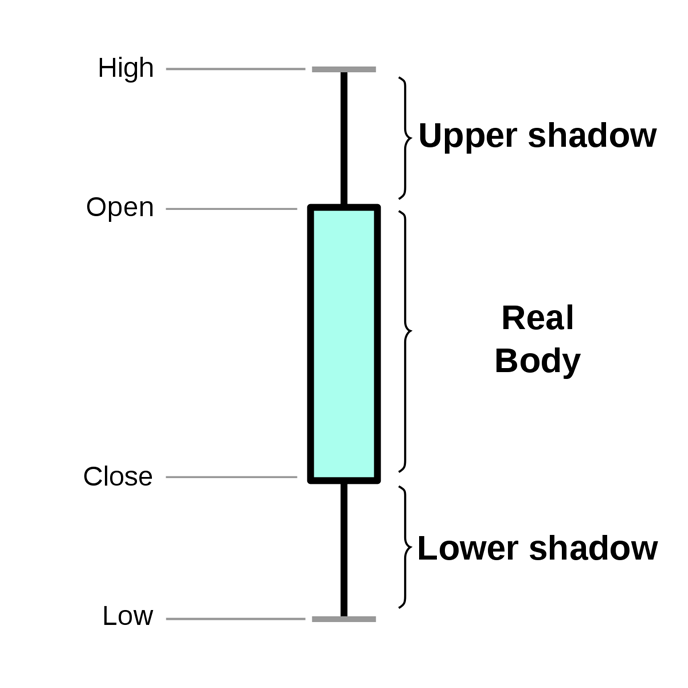

A Candlestick chart is a type of financial chart that represents the price action of a particular stock, commodity, or currency. Candlestick charts contain four different data points:

- High – The highest price paid that time interval

- Open – The price of open on that time interval

- Close – The price of close on that time interval

- Low – The lowest price paid during that time interval

The real body represents the space between the open and the close. If the open is higher than the close, the candle is red. If the open is lower than the close, the candle is green.

The upper shadow of the chart represents the space between the open/close and the high. The lower shadow represents the space between the open/close and the low price. The shadows can also be referred to as wicks.

Stop Losses and Crypto Scam Wicks

A stop-loss is a limit order placed on a centralized exchange which executes a buy or sell of a cryptocurrency once it reaches a certain price. Scammers will attempt to take advantage of this by buying a price up to a certain price to trigger the stop-loss. As a result, the price will move in the direction that the scammer intended.

For example, let’s say the price of PLS is at 5 cents and many investors are shorting PLS. A whale or an exchange can see this information on-chain and try to raise the price of PLS to 7 cents to hit the stop-losses. If the price hits 7 cents it will trigger all of the liquidations in that range and cause the price of PLS to go even higher.

High Leverage Trading, Liquidations, and Scam Wicks

Leverage trading is when an investor borrows money from a lender in order to potentially earn more money than they could have. The problem with this strategy is that if you win, you owe them a percentage of the gains. If you lose, you lose extra and it’s all on you.

For example, say you have $1000 and take 5x leverage. You now have $5000 to invest. However, now the price only needs to drop 20% to lose 100% of your investment. If the price of the crypto you were leverage trading wicks down briefly to 20% even more a few seconds, you stand to lose your entire investment.

Examples of Crypto Scam Wicks

Scam wick liquidations primarily happen on centralized exchanges.

Bitmex Scam Wick

BitMex XRP. On February 13th, 2020, the price of XRP on the centralized exchange Bitmex flash crashed from 31 cents down to 13 cents for only a few seconds.

This was long enough to trigger all of the liquidations from leveraged investors.

If you look on other exchanges, the prices of XRP did not wick in as drastic a fashion as on BitMex. This leaves you to wonder if this was just a technical design error, market manipulation, or centralized foul play.

Binance Scam Wick

Here is one more example of a price wick on Binance, which did not occur on any other centralized or decentralized exchanges.

How To Protect Yourself From Crypto Scam Wicks

Do Not use Centralized Exchanges.

There are myriad reasons to not use centralized exchanges. The main reason is to hold the keys to your own crypto. Scam wicks have highlighted an additional reason which is to avoid exposure to their centralized price feed data. Centralized exchanges likely pull price feeds from limited sources and/or control the prices themselves. This puts your option trades and stop losses at risk.

Do Not Leverage Trade (Especially with Low Liquidity).

This one should be self-explanatory by now. Smart men go broke three ways. Ladies, liquor and leverage. Avoid taking leverage, especially in markets as volatile as cryptocurrency. Scam wicks are just one way in which you can get rekt by leverage trading.

Use DeFi Protocols with Multiple Price Feeds from Decentralized Oracles.

One potential problem arising from scam wicks would be smart contracts which are reliant on accurate price feed data. For example, if the price of PLS wicks down abruptly within the Liquid Loans protocol, many vaults would be liquidated instantly. This would cause serious problems to the functionality of the protocol. To solve this problem, use protocols that rely on decentralized blockchain oracles such as Fetch Oracle.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Connor

Connor is a US-based digital marketer and writer. He has a diverse military and academic background, but developed a passion over the years for blockchain and DeFi because of their potential to provide censorship resistance and financial freedom. Connor is dedicated to educating and inspiring others in the space, and is an active member and investor in the Ethereum, Hex, and PulseChain communities.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant