Crypto Liquidity: Everything You Need To Know

Crypto liquidity refers to the ease and speed at which a cryptocurrency can be bought or sold in the market without causing significant price movements or slippage. It measures the availability of buyers and sellers in the market and the depth of the order book.

In a highly liquid crypto market, there are numerous active participants, both buyers and sellers, resulting in a large number of bids and asks at various price levels. This depth of market allows traders to execute their orders quickly and efficiently at or near the desired price.

What is a Crypto Liquidity?

Crypto liquidity is an omnipresent term in decentralized finance, so what does it mean? Simply put, liquidity is the ability to turn assets into real money. When a platform has ep liquidity, it means:

- You can instantly convert assets for dollars

- When selling large amounts (e.g., $1M+), your order doesn’t impact the asset price

- The market cap is large, and the price is stable. For example, it takes around $100M to change the Bitcoin price by 1%.

- Thousands of users can fill the same trading positions at once without delays.

When providing liquidity to decentralized platforms (DeFi dApps), deep liquidity means:

- There are a lot of crypto liquidity providers (investors providing funding)

- Lending and staking interest rates decrease

- The greatest contributors earn more passive income from platform fees

- Users can swap tokens with the same, if not better liquidity than traditional exchanges

While centralized exchanges keep custody of all funds, DeFi dApps use liquidity pools. A liquidity pool is a community-owned fund consisting of two or more tokens. It allows traders to swap tokens for a fee, part of which goes back to the liquidity provider.

For liquidity providers, liquidity means they can freely withdraw the invested amount anytime with a minimal loss risk. For traders, it means they can quickly trade any token with minimal spread. This is one difference between accounting and market liquidity.

Accounting Liquidity vs Market Liquidity

By definition, accounting liquidity is a company’s ability to pay off short-term debts. Applied to DeFi, it means investors should be able to withdraw their initial amounts anytime (if the platform has the funds). Because DeFi protocols are autonomous and users keep custody of their funds, accounting liquidity is guaranteed.

However:

- Accounting liquidity doesn’t represent the entire platform’s liquidity. For example, a decentralized exchange (DEX) might have one wallet for TVL, another for treasury, another for token burning…

- When liquidity pools are unbalanced, you won’t receive the same token proportion. This means the dollar amount can change from the initial deposit.

To avoid these losses, providers and traders need market liquidity. If accounting liquidity is the token amount available to users, market liquidity is the amount that keeps token prices stable. It reduces the risk of yield farming and the price spread when trading.

When market liquidity is low, traders pay different prices from market averages, which creates arbitrage opportunities. While high trading volume helps with market liquidity, there are different approaches. You can offer liquidity at all prices, or you can concentrate it on high-demand targets and prevent volatility in the first place (see Uniswap v3).

DEXs have several liquidity pools so that it’s possible to swap 100s of currencies within seconds. However, prices will be different from large exchanges because of the bid-ask spread.

What Is a Bid-Ask Spread?

The bid-ask spread is the difference between the prices that buyers and sellers are willing to pay. When there’s low crypto liquidity, there are fewer matching orders and bid-ask spreads are higher. When there’s high crypto liquidity and trading volume, you can trade at practically the same price in an instant.

Exchanges profit from trading fees and spread by matching opposite orders. For example, when you buy with a market order, you’re accepting someone else’s lowest sell order. If you want to buy at $10 but the only available seller is $11, there’s a $1 spread (10%).

Traditional exchanges have spreads below 0.5% because of their high trading volume and deep liquidity. But DEXs often don’t have that liquidity. For the least liquid pools, bid-ask spreads can go above 10%.

And unlike centralized exchanges, DEXs don’t support limit orders to prevent high spreads (unless they integrate oracle price feeds). Users pay for protocol fees (if there are), network fees, bid-ask spread, and slippage. Token swaps can take from 3 seconds to 20 minutes, and slippage is the % price volatility you’re willing to accept to complete the order (if higher, it’s canceled). Thankfully, a DEX with deep liquidity pools can be just as efficient, if not better, than traditional exchanges.

Note that bid-ask spreads aren’t the only spreads traders pay. There’s also the exchange spread, which creates revenue for the market maker.

What is a Market Maker?

The market maker is the company or software that matches opposite trades, ideally instantly. But these aren’t exact matches. The exchange might pair a $1 token buyer with a $0.98 token seller and profit from the difference.

You can call it exchange spreads, brokerage fees, or commissions. It’s a minimum price deviation traders pay besides bid-ask spreads. This difference can go to the platform’s treasury or accounting liquidity.

Without market makers, an exchange is just a peer-to-peer marketplace (similar to NFTs). Traders need them for liquidity, stable prices, and instant order fulfillment. But they don’t necessarily have to be centralized.

In DeFi, market makers are smart contracts. They are trustless, autonomous programs that manage funds and prices based on trading activity and liquidity pool balance. They use Automated Market Makers (AMMs).

What is an Automated Market Maker?

AMMs allow traders to quickly fulfill orders at the closest price, even if there are no buyers available. It’s an automated exchange between traders and liquidity providers with support from 3rd-party arbitrage traders. With enough liquidity, providers earn low-risk interest, and traders get low-spread orders.

When there’s not enough liquidity, providers earn high-risk interest, traders pay volatile spreads, and arbitrage traders profit more from price differences.

In centralized exchanges, order books match token supply and demand. In DeFi, AMMs try to match the balance of the token-pair liquidity pool. Otherwise, liquidity providers would withdraw their tokens in different proportions and market value.

When there’s fewer of one token in the pool, the AMM will raise its price to stop it from depleting. It will also make the second token cheaper to replace surplus tokens with scarce tokens. Because these unbalanced pools have different prices from the market, arbitrage traders will trade for those profits and rebalance the pool within seconds.

However, prices don’t always stabilize because crypto markets are volatile. That’s why today DEXs use different tactics to minimize risk:

- Offering liquidity in a price range to avoid impermanent loss

- Use liquidity from low-demand prices on high-demand prices

- Use asymmetric pools to distribute risk, such as 80/20 or 25/25/50

If a DEX can minimize the many risks of yield farming, liquidity providing could outperform trading.

Crypto Liquidity Providing Explained

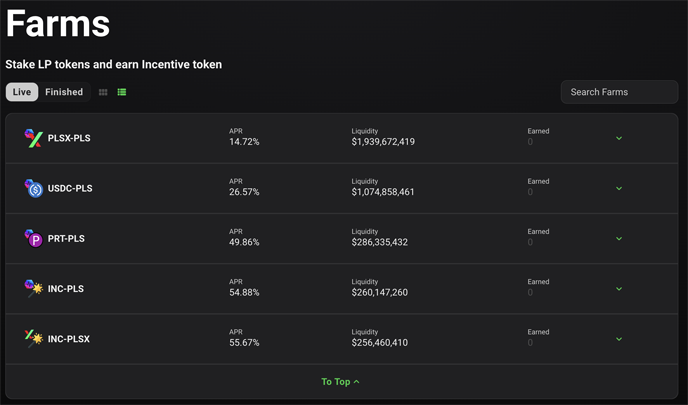

Liquidity providing is lending a pair of tokens to a DEX liquidity pool in a specific proportion. Unlike traditional lending or cold staking, liquidity providers can withdraw their funds anytime. As long as they stay in the liquidity pool, they will earn transaction fees earned from the platform and proportional to their contribution.

That also means providers have no liquidity while lending tokens. To solve this, many DEXs, like UniSwap v3, offer Liquidity Pool (LP) tokens. If you contribute 10% of a liquidity pool, you get 10% of the total LP tokens as a receipt.

LP tokens are proof of ownership of your share in the pool. They allow you to withdraw anytime without anyone’s intervention. It also means you can transfer ownership to someone else by sending or selling LP tokens.

Yield farmers can use these tokens for staking and collateral lending. Whenever you want to exit the liquidity pool, you return the LP tokens but keep all the interest earned, along with the pool’s fee revenue. There are different LP tokens for every pool, token combinations, and ratios.

As more liquidity providers join the pool, your contribution rate decreases, and so does your interest. But the biggest risk of liquidity pools is opportunity cost.

Risks of Liquidity Providing

The best DeFi rewards go for either large liquidity providers or those who provide for the longest. And if you wait long enough, you’ll expose to risks that can quickly wipe out weeks of profits. From most to least likely, there are:

- Price volatility: Interest earning takes time, but token prices can change by over 20% overnight. High-risk tokens offer better rewards, but are they worth the cost? Even stablecoins can lose price if they’re not over-collateralized.

- Impermanent loss: How much money would you make if you held or staked tokens rather than providing liquidity? That opportunity cost is the impermanent loss, and the bigger the pool unbalance, the bigger the loss. But if prices return back to normal, the loss doesn’t realize.

- Pool liquidity: Liquidity is at its lowest when it’s the most needed. During sharp market movements, investors might panic or withdraw all at once. If the liquidity pool loses volume, you’re more exposed to volatility and impermanent loss.

- Variable cost: It’s not 100% true you can withdraw anytime you want. It only makes sense if the slippage and spreads are below-normal (e.g., below 1% each). If you want to perfectly plan your exit, the fees at that moment might not be worth it. And while you wait, there is price risk.

- Smart contract vulnerabilities: Like any program, smart contracts can have vulnerabilities. Like any company, DAOs can make mistakes. Not only are problems expected, but it’s not legally clear who takes responsibility for losses other than yourself.

If you provide liquidity for long enough, even if returns offset the losses, losing is inevitable. There are lots of risks we haven’t discovered yet in the DeFi space, and we don’t even know all the consequences of the ones we already know. That’s why liquidity providers who prioritize risk management succeed more often than not.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Max

Max is a European based crypto specialist, marketer, and all-around writer. He brings an original and practical approach for timeless blockchain knowledge such as: in-depth guides on crypto 101, blockchain analysis, dApp reviews, and DeFi risk management. Max also wrote for news outlets, saas entrepreneurs, crypto exchanges, fintech B2B agencies, Metaverse game studios, trading coaches, and Web3 leaders like Enjin.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant